Existing Home Sales

“If a window of opportunity appears, don’t pull down the shade.” Tom Peters. The markets were closed Monday in observance of the Martin Luther King, Jr. holiday and the economic calendar was light, but last week still brought an opportunity, as home loan rates reached some of their lowest levels in months.

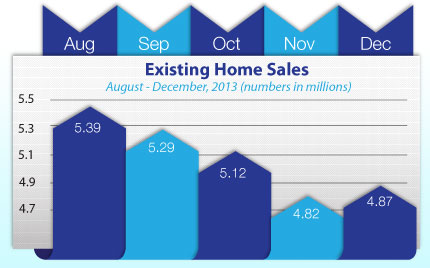

Despite the quiet calendar, there was news to note in the housing arena. The National Association of Realtors reported that Existing Home Sales rose by 1 percent from November to December to an annual rate of 4.87 million units. This was the first monthly gain in three months. For all of 2013, there were 5.09 million existing home sales, which was 9.1 percent higher than 2012. The housing market continues to rebound, though at a modest pace.

Despite the quiet calendar, there was news to note in the housing arena. The National Association of Realtors reported that Existing Home Sales rose by 1 percent from November to December to an annual rate of 4.87 million units. This was the first monthly gain in three months. For all of 2013, there were 5.09 million existing home sales, which was 9.1 percent higher than 2012. The housing market continues to rebound, though at a modest pace.

Meanwhile on the labor front, weekly Initial Jobless Claims were reported at 326,000, up 1,000 in the latest week and nearly in line with expectations. Initial Jobless Claims have been trending lower since the distortions brought on by seasonal holiday hiring. The labor markets were pointed in a positive direction up until the weak December Jobs Report. The Fed will be watching closely to see if the December report was an anomaly…or a sign of things to come.

What does this mean for home loan rates? The housing and labor arenas are two key areas that the Fed is monitoring, as it decides whether to further taper its Bond purchases. Remember that the Fed is now purchasing $40 billion in Treasuries and $35 billion in Mortgage Bonds (the type of Bonds on which home loan rates are based) each month to stimulate the economy and housing market. This figure is down from the $85 billion in Bonds and Treasuries the Fed had been purchasing last year.

The Fed has stated that its decision to further taper these purchases will be dependent on economic data. The upcoming Fed meeting on January 29-30 will be closely watched, as investors will be waiting to see if the Fed will taper these purchases further. This decision could have a big impact on Mortgage Bonds and home loan rates, and it’s a key story to watch this week and throughout the year.

The bottom line is that now remains a great time to consider a home purchase or refinance, as home loan rates remain attractive compared to historical levels. Let me know if I can answer any questions at all for you or your clients.